40+ Borrowing money interest rate calculator

If youre borrowing money as in a mortgage or loan the interest rate tells you how much itll cost to have that money from the bank. Its important for you to work out what your loan will cost you in terms of monthly repayments over the term.

How To Calculate Loan Amount Microsoft Excel Quora

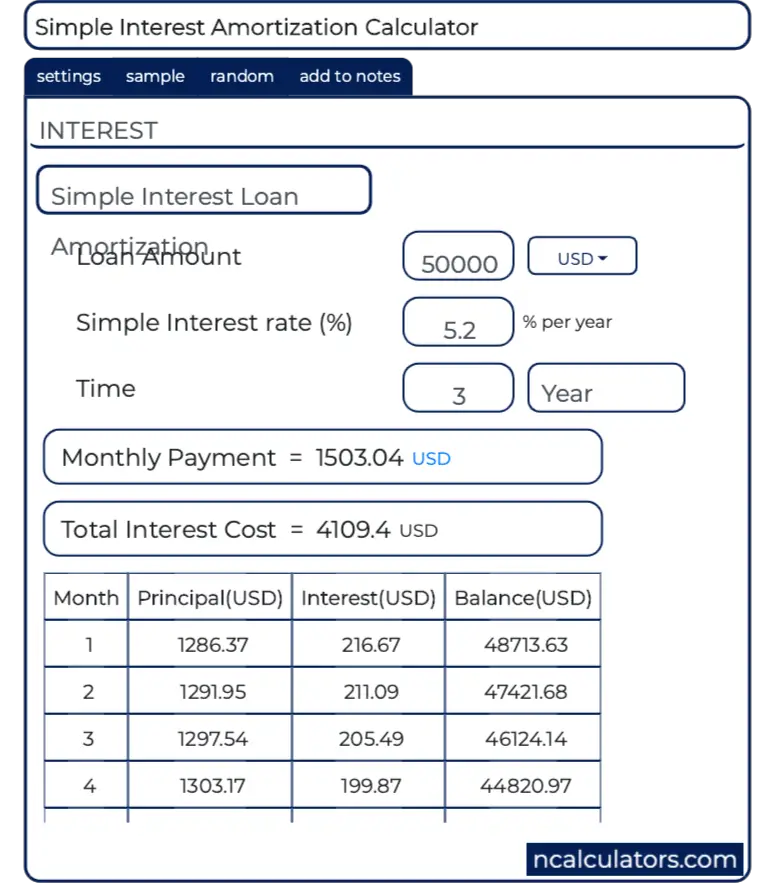

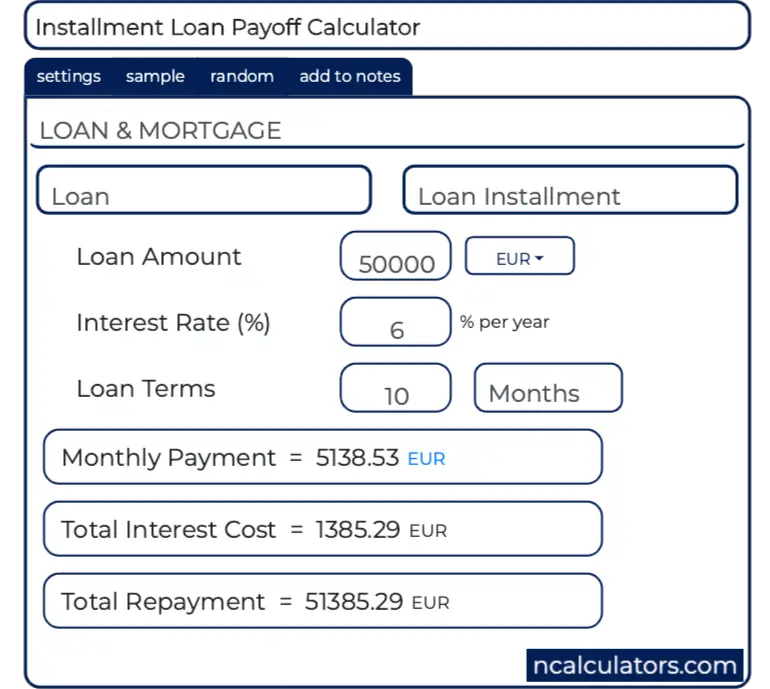

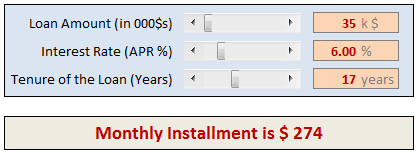

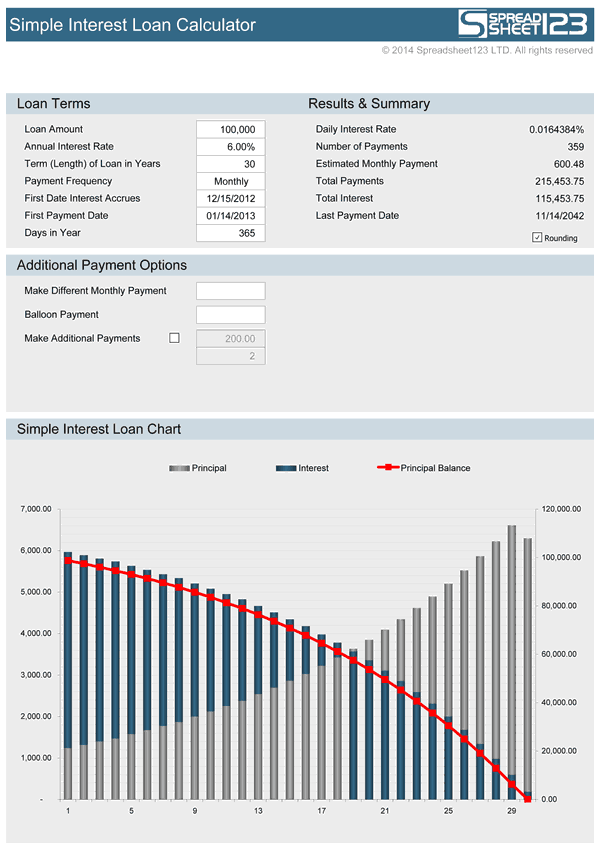

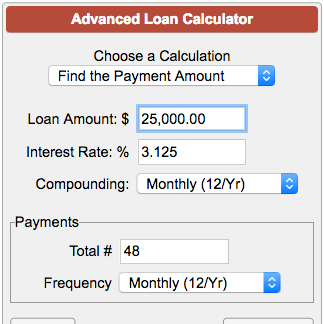

So we developed a user friendly loan payment calculator which figures it all out for you.

. For the first year we calculate interest as usual. An important aspect of business borrowing is the form of security required - property or business assets. Your annual interest rate is 6.

An individual with a fixed interest rate may decide to refinance the loan. As an example you may wish to reinvest 80 of the daily interestearnings you receive and withdraw the other 20 in cash. This calculator will help you to determine the principal and interest breakdown on any given payment number.

Interest is the price you pay for borrowing money from a lender. On the other hand APR is a broader measure of the cost of a loan which. Additional rate taxpayers.

For long term borrowing some for up to 40 years. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. The mortgage interest rate If you dont know the mortgage rate the calculator has three example rates that you can use.

How tight or loose market regulation is. Whether youre looking to take a 5000 loan or even 15000 our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that. The Reserve Bank of India RBI announced on 5th August 2022 that the Monetary Policy Committee MPC of the Reserve Bank of India RBI raised the repo rate by 50 basis points bps to 540.

Other factors beyond the Federal Reserve which impact housing prices include. A high RBA cash rate is usually not as good news for those borrowing money as it is for those saving money and vice versa. The repo rate is the interest rate at which the central bank of the country lends money to the recognized commercial bank to achieve several fiscal.

Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. And deposit money the interest rates will remain high. 7 min-40 max plus agent Fees where applicable Useful downloads.

These are often the cheapest ways to borrow money and save on interest with a low interest loan. The difference can be up to thousands of dollars. Can earn 1000 in savings interest per year without paying tax on the interest.

A cheaper rate of interest for a secured. An implicit interest rate is the nominal interest rate implied by borrowing a fixed amount of money and returning a different amount of money in the future. As of September 2022 the cash rate target is 235.

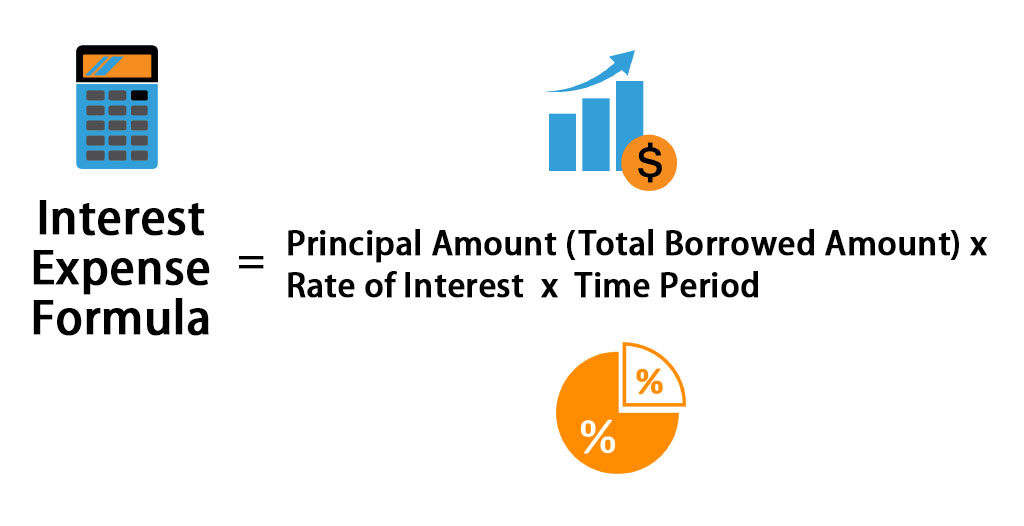

For car loans the interest rate is commonly referred to as the Annual Percentage Rate or APR. Term deposits earn very similar interest rates to savings accounts and are heavily tied to the cash rate. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

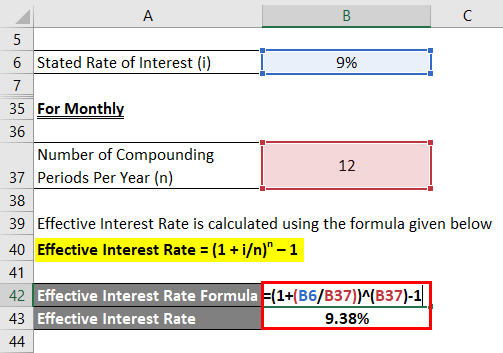

The daily reinvest rate is the figure that you wish to keep in the investment for future compounding. So lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. EAR Effective Annual Rate - The Effective Annual Rate is used to express the cost of borrowing on current accounts.

Every month excluding January RBA Board members determine the cash rate in a meeting. For example if you borrow 100000 from your brother and promise to pay him back all the money plus an extra 25000 in 5 years you are paying an implicit interest rate. We will advise you of your debit interest rate when your application for the account is approved.

These are the average mortgage rates for 2 3 and 5-year fixed rate. Use this calculator to test out any loan that you are considering. We maintain this page because the changes reveal important interest-rate trends that drive business lending rather than revealing specific lending cost levels.

Issuer Plan Interest free period Fee primary Balance transfer Balance transfer period Cash Adv Purchases Gem. Charges apply to full early repayment while there are no fees for just paying extra off. The number of months and the interest rate and the calculator will.

The interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. By tweaking the loan amount loan term and interest rate you can get a sense of the possible overall costYou will see that as. What will my loan cost.

Thanks for all your help. Virgin Money M. Your interest rate multiplied by the outstanding principal amount is the interest you owe for a particular period of time.

I then read more money with NW and have followed the principles in that ever since and Im now 22 years old earning between 100-110k and about to buy my first investment property. Relatively late compared with other central banks in raising interest rates the RBI has raised the repo rate from a pandemic-era record low 400 to 540 over the last four months. You want to calculate the interest you owe for.

This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Assume that your principal amount is 10000. Loan amount Annual interest rate 0 to 40 Term of loan months 1 to 360 Desired.

Given Australias record-low cash rate youll struggle to find a term deposit paying over 200 pa. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. By definition the interest rate is simply the cost of borrowing the principal loan amount.

Higher rate taxpayers 40 can earn 500 in savings interest per year without paying tax. Borrowing is available on terms up to 7 years although the 340 rate is capped at a maximum of 5 years. The EAR takes account of the rate of.

Term deposit interest rates are fixed but they tend to vary depending on the term you choose thats how long you deposit your money for.

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

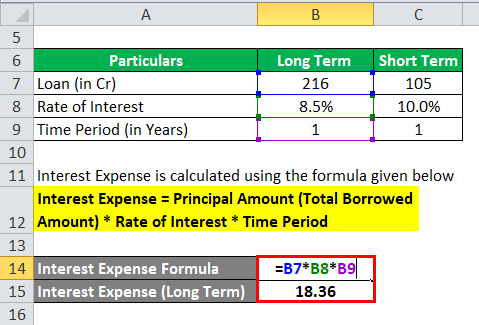

Interest Expense Formula Calculator Excel Template

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

![]()

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

Interest Formula Calculator Examples With Excel Template

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

Mortgage Payment Calculator Mortgage Calculator Using Microsoft Excel

Effective Interest Rate Formula Calculator With Excel Template

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Effective Annual Rate Formula Calculator Examples Excel Template

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

10 Best Instant Payday Loans With No Credit Check Get Online Cash Advance For Bad Credit 2022

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

Interest Calculator For Loan Sale 51 Off Ilikepinga Com

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Effective Interest Rate Formula Calculator With Excel Template

Interest Expense Formula Calculator Excel Template